missouri no tax due system

Property is not subject to Missouri sales tax and the property is not stored used or con-sumed in this state no Missouri tax is due. For those who previously filed MO-1040P you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A if applicable.

No Tax Due Please enter your MOID and PIN below in order to obtain a statement of No Tax Due.

. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. 2 Definition of Terms. Ad The Leading Online Publisher of National and State-specific Legal Documents.

If you are looking for the latest and most special shopping information for State Of Mo Department Of Revenue Sales Taxes results we will bring you the latest promotions along with gift information and information about Sale Occasions you may be interested in during the year. No Tax Due State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can receive or obtain certain licenses that are required to conduct business in the state. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now.

Therefore we prioritize updating the latest. JEFFERSON CITY Missouri will be the last state in the nation to start collecting sales tax on online purchases. The state wont see the revenue roll in until January 2023.

Ad Find Mo No Tax Due. Federal Employer Number ID. Mike Parson signed the bill into law last week but it will be 18 months before the Department of Revenue will start collecting the online taxes.

The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. You will need your businesss Missouri Tax Identification Number and tax filing PIN. A business may obtain a no tax due online if it.

See MO-1040 Instructions for more details. Use tax is imposed on the storage use or consumption of tangible personal property in this state. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due.

The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. The Kirksville License Office located at 105 W Potter Ave opened today at 8 am. A sale of a taxable service is subject to sales tax if the service is performed in Missouri.

The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. Clayton License Office Opens JEFFERSON CITY The Clayton License Office located at 141 N Meramec Ave Suite 201 opened on Jan. No Franchise Tax Due Form MO-NFT - 2014 No Franchise Tax Due Reset Form Form MO-NFT Department Use Only MMDDYY Missouri Department of Revenue 2015 No Franchise Tax Due Taxable Year Print Form Beginning Ending MMDDYY MMDDYY Missouri Tax ID.

See MO-1040 Instructions for more details. If you need a Full Tax Clearance please fill out a Request for Tax Clearance Form 943 Reason For Request Form 5522. If you need a No Tax Due certificate for any other reason you can contact the Tax clearance Unit at 573-751-9268.

If the service is not performed in Missouri the sale is not subject to tax. Number Charter Number Corporation Name Balance Sheet. In other words a business must show that it has No Tax Due.

For office hours and days of operation for the Kirksville License Office please visit the License Office Location Map at dormogovlicense-office-locator or call 660-665-0292. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state. For those who previously filed MO-1040P you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A if applicable.

Promotions can be up to 66 with limited quantities. Search a wide range of information from across the web with topsearchco. A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state withholding tax and state sales tax before a city county or state agency will issue or renew any licenses required for conducting business where goods are sold at retail.

For office hours and days of operation for the Clayton License Office please visit the License Office Location Map at dormogovlicense-office-locator or call 314-499-7223.

Where S My Refund Missouri H R Block

Hickman Mills C 1 School District Hmc1proud Twitter

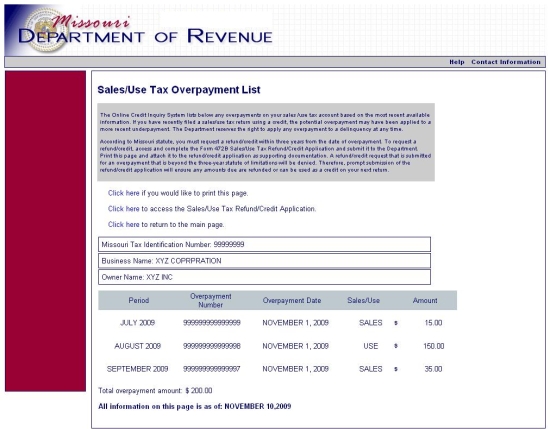

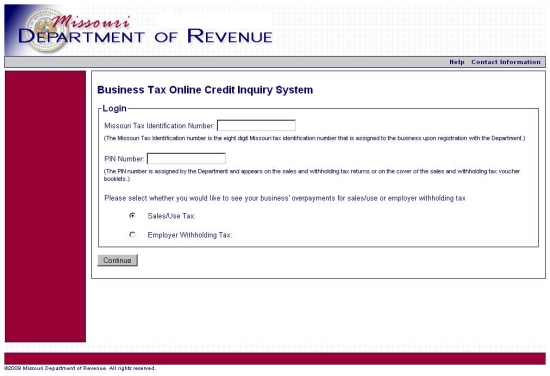

Sales Use Tax Credit Inquiry Instructions

Personal Property Tax Jackson County Mo

Sales Use Tax Credit Inquiry Instructions

Annuity Taxation How Various Annuities Are Taxed

Rainwater Harvesting Laws You Need To Know About

Sales Use Tax Credit Inquiry Instructions

Back To School Sales Tax Holiday

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Use Tax Credit Inquiry Instructions